Covering COVID-19 is a daily Poynter briefing of story ideas about the coronavirus and other timely topics for journalists, written by senior faculty Al Tompkins. Sign up here to have it delivered to your inbox every weekday morning.

Covering COVID-19 is a daily Poynter briefing of story ideas about the coronavirus and other timely topics for journalists, written by senior faculty Al Tompkins. Sign up here to have it delivered to your inbox every weekday morning.

When the White House warns that the inflation rate will be “highly elevated” two days ahead of today’s release of Consumer Price Index figures, you can bet the news will be bad.

It might be useful to look back at historical data to see that these spates of high inflation happen once in a while in the U.S. economy. Today’s CPI figures are just below the difficult three-year inflationary run of 1979 to 1981. Put another way, a person who is 40-year-old now would never have lived in a time of consumer-level inflation that was higher than 6.2%. For most of their life, inflation was running at around 3%. Rapidly rising gasoline and food prices are a life event they have never experienced, unless they have lived outside the United States.

Inflation spikes usually last a year and then calm down. Sometimes, like 100 years ago, they hang on and cause deep economic damage. Here are the inflation rates from 1917-1921, when after four years of double-digit inflation, the dam broke in 1921.

14 states have issued stimulus checks to try to blunt the effects of inflation — which, in an odd way, add to inflation by increasing consumer spending.

Colorado is sending a tax rebate of $750 for individual filers and $1,500 for joint filers this summer. In about a month, Hawaii will send $300 to taxpayers who earn less than $100,000 per year, and $100 to those who earn $100,000 or more per year. A million Californians will get rebate checks of about $1,000, and Illinois plans to waive taxes on groceries and gas as well as send out rebate checks to some taxpayers. Georgia, Delaware, Idaho, Indiana, Maine and New Mexico are also planning to get some tax dollars back into people’s pockets by way of rebates and other programs.

Rural America feels inflation the most

The Rural Blog points to an Iowa State University study that shows why rural Americans are feeling the effects of inflation more intensely than people living in cities and towns. Iowa State rural sociologist and professor David Peters explains:

The current wave of inflation has made rural families more vulnerable than urban families due to rising gasoline prices, higher fuel oil costs to heat their homes, and the ability to purchase less expensive used cars.

In 2022, rural household expenses rose by 9.2% overall, but earnings also rose by 2.6%.

The net effect cut rural disposable incomes by 38.0%.

Expenses now consume 90% of rural take-home pay. Urban disposable income only dropped by 17% due to slower inflation rates (7.6%) and faster wage gains (4.3%).

“Expenses grew faster in rural places, especially for gas and diesel, which now costs rural families an extra $900 this year. Also, rural incomes grew slower, which means wage gains are not enough to offset price increases.”

“This combination cut rural disposable incomes by 33% from this time last year. Loss of this extra cushion makes rural Americans more vulnerable to getting into debt from unexpected expenses, like medical costs, car repairs or even a temporary reduction in hours at their job,” Peters noted.

Second COVID-19 boosters for all?

The Washington Post reports that the Biden administration is working on a plan that might lead to a national effort to administer second COVID-19 booster shots to everyone, not just seniors and people who are immunocompromised.

The effort is a response to the increasing rate of COVID-19 infections in the U.S., which now is estimated to be about 112,000 new cases every day. That is the highest rate since March.

The troubling thing about BA.5

The newest omicron subvariant of the COVID-19 virus could be the most concerning yet. Scientists believe it has the ability to dodge antibodies that previous infections and vaccines provide. That means more reinfections and breakthrough infections for people who are vaccinated.

Even with a BA.5 infection, vaccinations provide enough protection to keep symptoms from becoming deadly. But epidemiologists say our reluctance to get vaccinated a year ago has given the virus the opportunity to keep morphing for another winter.

The Daily Beast explains it this way:

BA5 might be a preview of the months and years to come. A year ago, we had a chance to block SARS-CoV-2’s main transmission vectors through vaccines and social distancing.

But we didn’t. Restrictions on businesses, schools and crowds have become politically toxic all over the world. Vaccination rates remained stubbornly low, even in many countries with easy access to jabs. In the U.S., for example, the percentage of fully vaccinated has stalled at around 67 percent.

So COVID lingers, 31 months after the first case was diagnosed in Wuhan, China. The longer the virus circulates, the more variants it produces. BA.5 is all but inevitable result of that tragic dynamic.

Post-COVID chronic school absenteeism — where are the ‘missing’ students?

In this Sept. 13, 2021, file photo, students board a school bus on New York’s Upper West Side. (AP Photo/Richard Drew, File)

Governing.com, a resource for local and state government leaders, warns:

Chronic absence soared during the pandemic, and graduation rates dropped for the first time in 15 years. The first step out of this dangerous trend is knowing more about who’s missing.

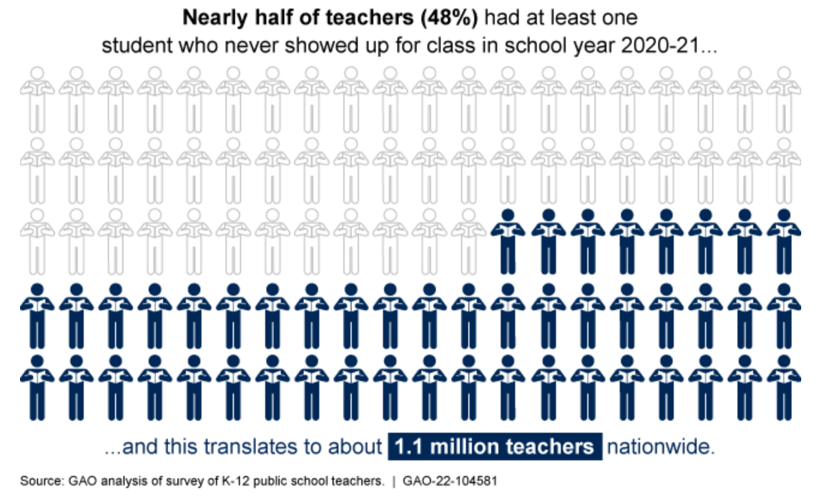

Indeed, half of all teachers surveyed report there are students who, since the pandemic began, have disappeared from the system. Nobody seems to know where they are. The U.S. Government Accountability Office estimates that 1.1 million teachers have missing students, and that number is probably conservative.

Some of the missing students never showed up for virtual classes, which could indicate they did not have computer access. Others didn’t show up for in-person teaching. The largest percentage of missing kids are high school students, but many are much younger. Some children had to care for family members. Others had no adult to help them navigate hybrid learning.

The report points to a GAO survey that found:

Nearly half of K-12 public school teachers had at least one student who never showed up for class in the 2020-21 school year. The majority of these teachers said that, compared to a typical year, they had more students who never showed up for class. A variety of obstacles kept students from showing up, including limited or no adult assistance at home and competing demands on students’ time such as providing care to a family member. These students predominately came from majority non-White and urban schools.

The long-term impact of the disruptions of the last 2 years on student enrollment and attendance remains to be seen, particularly for students with whom schools have lost contact. As we previously reported, even though many schools provided students with computers and internet access to participate in virtual instruction, many students faced difficulties staying engaged in school or disappeared from school altogether. While the issue of students not showing up at all during the pandemic is of grave significance, little is known about the obstacles these students face or the types of schools they come from.

About those ‘fentanyl-laced’ dollar bills

You probably have seen the blizzard of warnings about people picking up dollar bills that were dropped on the ground only to find the paper had been coated in deadly fentanyl. One story in Nashville got some media attention this weekend after a woman said she picked up a dollar and ended up in the emergency room.

But doctors say it is not likely that she was exposed to fentanyl. And WSMV reports, “Police responded to the hospital on Sunday. A spokesperson told WSMV that officers did not see any sort of residue on the dollar bill, but it was not tested for fentanyl since no one is being charged.”

Despite the doubts, the story about the contaminated dollar is everywhere.

A sheriff in Tennessee recently issued a warning about dollar bills that could carry fentanyl. They say they found one bill that tested positive for meth and fentanyl.

I have seen similar warnings out of Alabama that got picked up by news websites around the country, perhaps making this seem like a common national problem.

I am not saying these cases don’t exist. But the sheer volume of stories about these contaminated bills exaggerates any proof that there is some national threat to worry about. It reminds me of the fake stories years ago about LSD-laced tattoos, stamps and candy. We have enough real stuff to worry about without inventing problems.

Over-the-counter birth control pills possible soon

A French drug company, HRA Pharma, is asking the Food and Drug Administration to approve an over-the-counter birth control pill in the United States. The formal applications set the review process, which usually takes several months, into motion to see if the drug is safe and effective.

It could be one of the biggest developments in contraception in the 60 years since “the pill” became available with a physician’s prescription. The HRA Pharma pill is already available by prescription.

A second drug company, Cadence Health, says it also is close to submitting its OTC application to the FDA.

HRA Pharma’s announcement said that the timing of the application being so close to the U.S. Supreme Court’s decision on abortion rights is a coincidence and that the company has been working on the application for some time.

The application raises a few questions, including whether over-the-counter approval would make contraceptives available to minors without parental approval. And some health advocates worry that if patients do not need to turn to a physician for contraception prescriptions, they might skip regular exams altogether.

The good news about bookstores in America

Customers browse while shopping for books at the Strand Bookstore, Saturday, Nov. 28, 2020, in New York. (AP Photo/Mary Altaffer)

The New York Times shares some news that might give you hope for humanity:

300 new independent bookstores … have sprouted across the United States in the past couple of years, in a surprising and welcome revival after an early pandemic slump. And as the number of stores has grown, the book selling business — traditionally overwhelmingly white — has also become much more diverse.

Two years ago, the future of independent book selling looked bleak. As the coronavirus forced retailers to shut down, hundreds of small booksellers around the United States seemed doomed. Bookstore sales fell nearly 30 percent in 2020, U.S. Census Bureau data showed. The publishing industry was braced for a blow to its retail ecosystem, one that could permanently reshape the way readers discover and buy books.

Instead, something unexpected happened: Small booksellers not only survived the pandemic, but many are thriving.

Some stores have found that communities see bookstores not as retail establishments, but as gathering spaces. The American Booksellers Association says membership is up, profits are up and, in 2021, book sales rose 10% over 2020.

We’ll be back tomorrow with a new edition of Covering COVID-19. Are you subscribed? Sign up here to get it delivered right to your inbox.