President Joe Biden has accused some Republicans of threatening Social Security’s future, a charge they have denied.

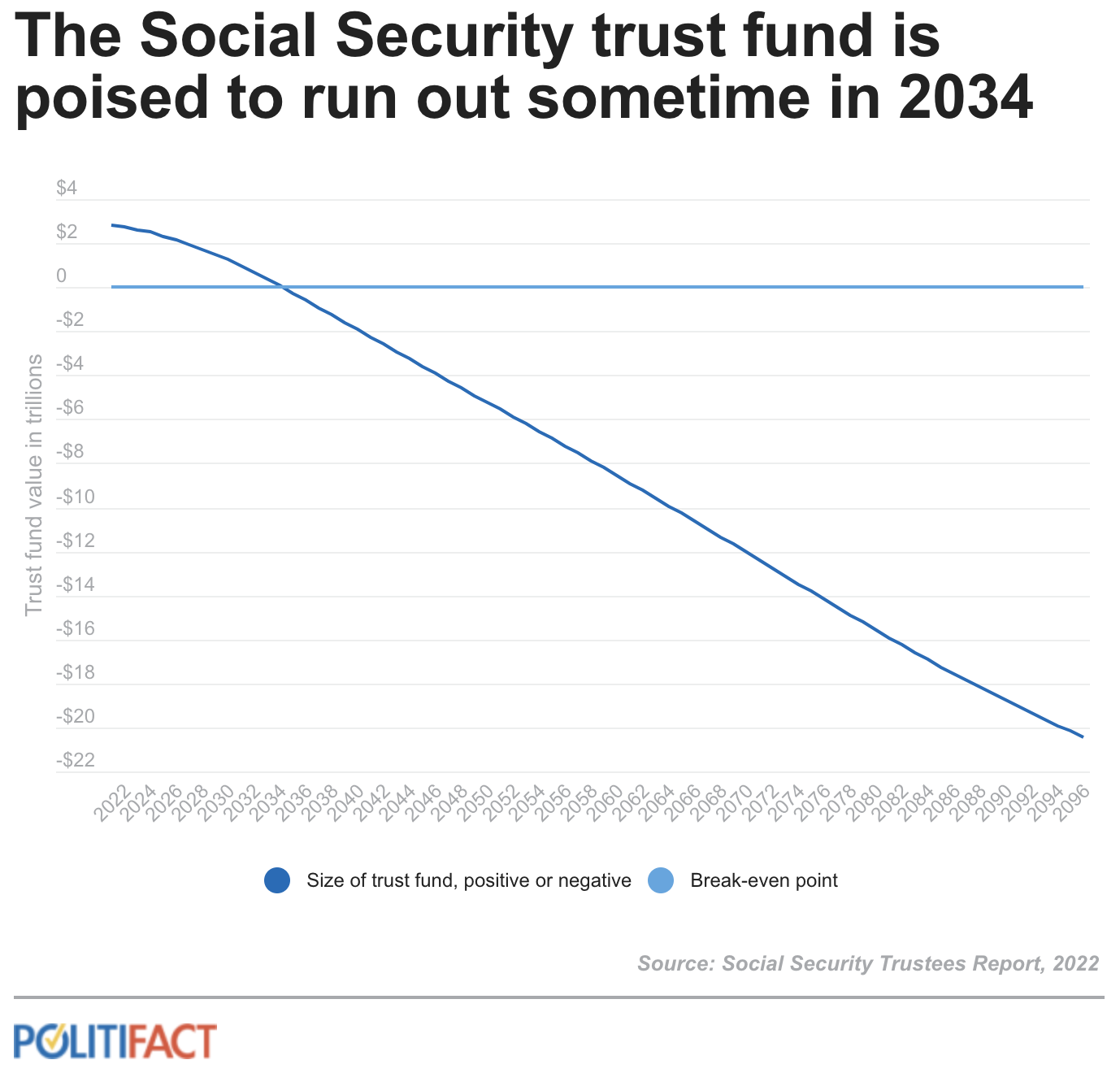

The attack — and the defense — ignore these facts about Social Security: the Social Security trust funds could be depleted as early as 2032, unless Congress acts to prevent that. Without action, starting in 2035, Social Security beneficiaries would get smaller monthly checks, about a 23% cut from what they receive now.

Almost 67 million Americans this year will receive Social Security payments, totaling about $1 trillion. Many older Americans rely on the benefits to pay their basic living expenses. People can start receiving Social Security retirement benefits at age 62, but full benefits kick in when they turn 67.

Most politicians from both parties are generally loath to propose changes to Social Security. Political pundits referred to it as the “third rail” in American politics — you touch it, you lose at the ballot box, where older voters typically have the highest voter turnout.

Social Security is funded through the payroll tax; that revenue is put into a trust fund to pay for current beneficiaries.

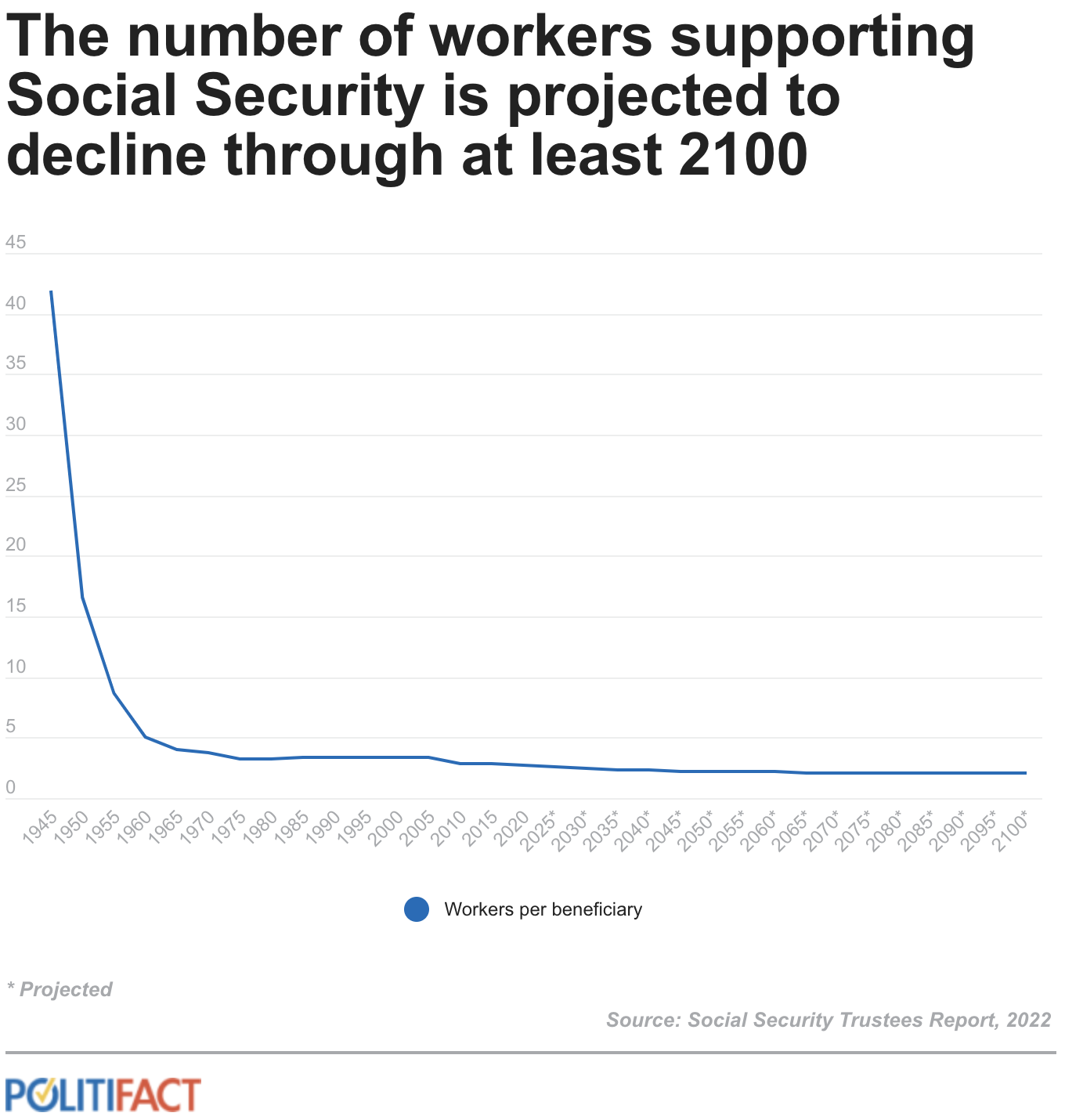

The program, which was started in 1935 by President Franklin D. Roosevelt’s administration, has become increasingly unaffordable as the life expectancy and number of eligible recipients has risen and the number of workers who pay into the program has declined.

(PolitiFact)

A 2022 Social Security trustees report said the trust fund used to pay retirees will be depleted in 2034. Congressional Budget Office Director Phillip Swagel told reporters Feb. 15 that the depletion would come even earlier: in 2032.

“These are all projections, so it depends on what happens with wages, life expectancy, immigration, inflation, etc.,” said Marc Goldwein, senior vice president for the Committee for a Responsible Federal Budget, a nonpartisan think tank.

The 2022 report is not an outlier. Since 2012, The Social Security program’s trustees board has projected that the fund will be depleted between 2032 and 2035, said Emerson Sprick, a senior economic analyst at the Bipartisan Policy Center, another nonpartisan think tank.

The main ways to keep Social Security solvent are by increasing revenue or decreasing benefits. A solution will likely require a mix of both.

More revenue could come in by increasing:

- The payroll tax rate;

- The amount of payroll taxes collected; or

- The ratio of people paying payroll taxes to people drawing benefits. For example, if more working-age people migrate to the United States, that could increase the number of people paying income taxes.

The federal government could spend less in benefit payments by raising the retirement age — effectively cutting the number of beneficiaries. Another way to decrease benefit payments is by decreasing the income replacement rates (retirement income or Social Security benefits relative to pre-retirement earnings).

These options to increase revenue or cut benefits have been on the table since the solvency problem first emerged in the 1990s, wrote R. Douglas Arnold, an emeritus professor at Princeton University who wrote a book about Social Security.

“It is devilishly difficult to protect both taxpayers and beneficiaries in a self-funded program like Social Security,” Arnold wrote in an April 2022 MarketWatch op-ed. “Some groups will have to pay the solvency costs. The only question is which ones.”

(PolitiFact)

Republican plans for Social Security avoid major changes for current retirees

Republican lawmakers don’t have a unified plan to shore up Social Security.

In 2022, the House Republican Study Committee, a 50-year-old conservative caucus, produced a plan that largely made no changes for current or near-retirees.

Although the plan proposed increasing the minimum benefit, it also called for reducing benefits for people who retire after 2030 (those cuts would affect mainly people with high earnings).

The committee’s plan also would raise the age at which people could claim their maximum payment, from 67 today to 70 in 2040. Raising the retirement age is equivalent to a benefit cut. People who opt for benefits before 70 could continue to work and not face a temporary reduction in their monthly checks, as they do now if they retire early.

The plan’s architects included no tax increases and called for Congress to allow workers and employers to put money into private retirement funds rather than the Social Security trust funds. The House committee is expected to release another plan this year for the fiscal year 2024 budget.

In 2022, Sen. Rick Scott, R-Fla., unveiled a broad policy agenda proposing that all federal legislation sunsets in five years and be renewed by Congress only if it’s “worth keeping.” Although his plan didn’t specifically mention Social Security, that program was created through federal legislation decades ago. Scott didn’t get much support from his party on that idea, and Biden repeatedly alluded to it in speeches claiming that Republicans want to end Social Security. In a Feb. 17 Washington Examiner op-ed, Scott said Social Security would be excluded from the sunsetting plan.

Republican leaders have also ruled out overhauling Social Security.

“There is no agenda on the part of Senate Republicans to revisit Medicare or Social Security. Period,” Senate Minority Leader Mitch McConnell said Feb. 14.

House Speaker Kevin McCarthy, R-Calif., said Jan. 29 on CBS’ “Face the Nation” that cuts to Social Security or Medicare are “off the table.”

Democratic plans for Social Security also have shortcomings

On Feb. 13, Sen. Bernie Sanders, I-Vt., joined several Democrats in reintroducing the Social Security Expansion Act. Sanders’ plan would increase benefits and keep Social Security solvent for 75 years by significantly expanding tax revenues.

Currently, up to $160,000 of earnings are subject to the payroll tax; Sanders’ plan would also add in that tax for earnings above $250,000. (People whose earnings fall in the middle would not be subject to the tax.)

However, Sanders’ plan would potentially reduce tax revenue for other programs, such as Medicare and Medicaid, said Richard Johnson, an Social Security expert at the Urban Institute, a social policy research think tank.

In 2021, Rep. John Larson, D-Conn., introduced a bill that changed payroll taxes calculations in a way that would sustain the Social Security trust funds. More than 200 lawmakers co-sponsored the bill, but it never got a vote. A related Senate bill also died.

His plan sought to increase revenue by levying the Social Security payroll tax on earnings above $400,000; that would have increased the life of the trust fund by only a few years, Johnson said.

Experts call for bipartisan solution

So far, Democrats and Republicans have not supported each others’ proposals to protect Social Security.

The last major bipartisan Social Security reform came in 1983 when the federal government was on the verge of being unable to pay full benefits, Johnson said.

The 1983 law gradually raised the full retirement age from 65 to 67 and increased the payroll tax rate.

Goldwein, from the Committee for a Responsible Federal Budget, said both parties will need to cooperate if they want to protect Social Security.

“I don’t know if it is this year or in 11 years,” Goldwein said. “But I think ultimately what’s going to happen is going to be bipartisan, because there is no other way.”

This fact check was originally published by PolitiFact, which is part of the Poynter Institute. See the sources for this fact check here.