UPDATE: The two companies announced on Monday afternoon that the deal has been finalized. Read more here.

GateHouse and its parent New Media Investment Group are ready to close a deal to acquire Gannett.

The principals will not confirm the deal until a definitive agreement is complete. However two sources with knowledge of how the transaction has evolved have confirmed that on background.

Here are some questions and answers about the impending merger, heading into an eventful week.

What will happen right away? At a minimum expect a closing announcement to include a price and the name of the new company. The price? Somewhere north of $10.75 where Gannett shares, bid up by Wall Street, closed Friday. The name? My bet (and Nieman Lab’s Ken Doctor’s) is that it will be Gannett.

[the_ad id=“667826”]

But I thought GateHouse was buying Gannett, not vice versa? Yes, Gannett and its flagship USA Today are brands with a long history and credibility with customers. GateHouse not so much, and New Media Investment not at all.

For a precedent, look at NationsBank’s purchase of Bank of America in 1998. The acquirers took their partner’s storied name going forward, and the Nations Bank brand is now long forgotten.

Will cuts be announced? Already $275 million to $300 million in cost-saving “synergies” has been floated. The majority of that would come from consolidating business functions, and maybe smaller news staff reductions. The deal also has the potential to increase revenue — say in national advertising sales.

I would not expect a lot of details until later.

Who’s in and who’s out when the companies are put together? At the top corporate level, GateHouse execs will get the big jobs. Mike Reed, chairman and CEO of New Media Investment, will almost certainly assume the same title and responsibilities. (Gannett has been without a CEO this year).

Severance deals (aka golden parachutes) for Gannett’s corporate team have recently been put in place, a well-informed source told me — one of many tells that the transaction is imminent.

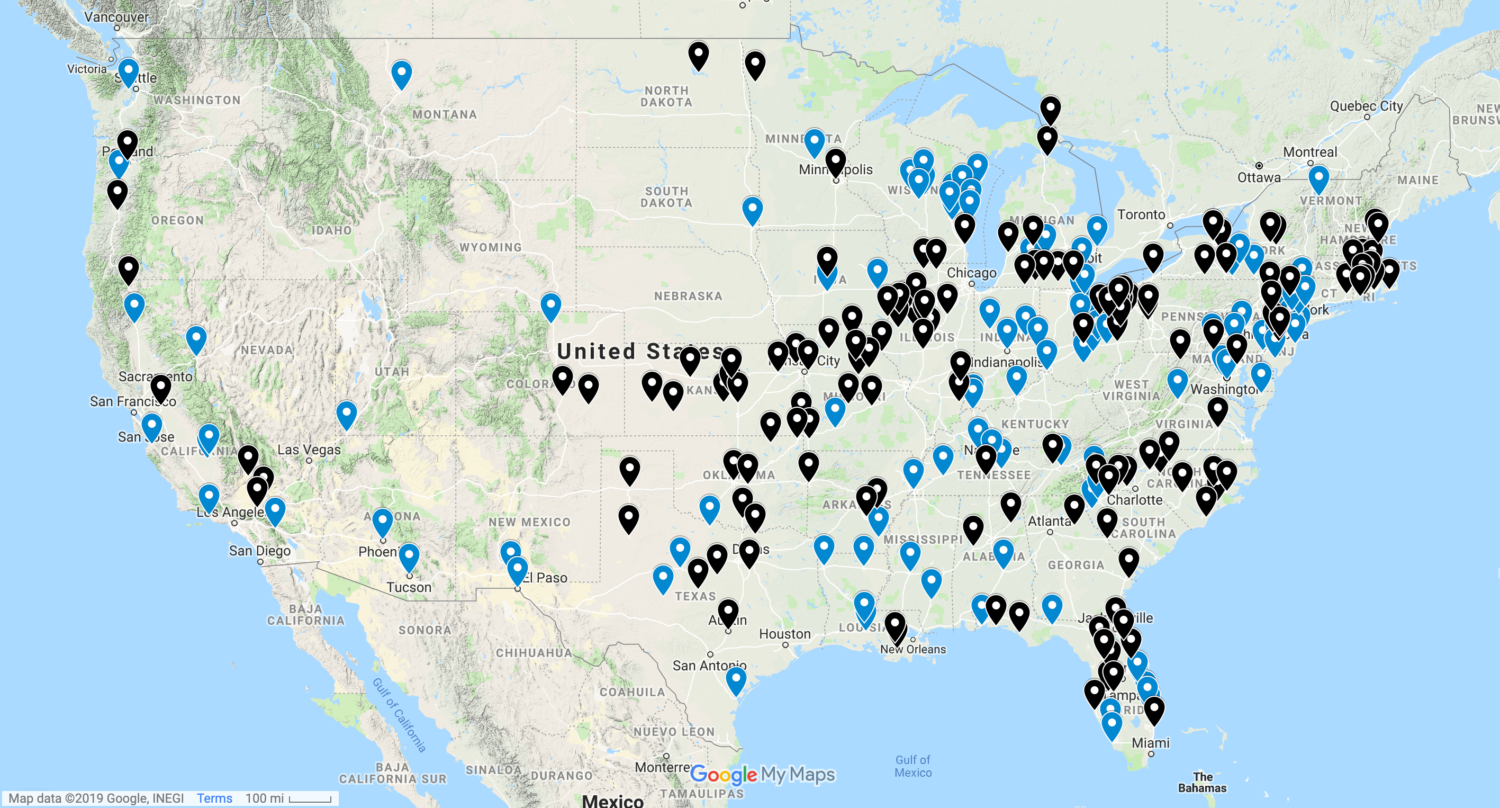

How about the newsrooms and other operations of the 250-plus papers involved? That will take longer to sort out. Both chains have been moving to group editors with responsibility for several papers. Both count on top-down corporate moves and directives to keep the component parts of the company moving in the same direction.

Editorially, both rely on centralized layout centers to put print editions together across the chain. Those will need to be combined, as eventually will CMS systems.

Over the last five years, Gannett’s USA Today Network has started to produce ambitious investigative projects drawing on reporting from the regional papers and a shared unit analyzing data and assembling the stories. GateHouse is in the midst of creating a similar 30-person investigative unit.

[the_ad id=“667872″]

The merged company will now dominate in number of titles in several states including Florida and Ohio, adding muscle for political and other statewide coverage.

When will this happen? In days? Weeks? Could be either — and there is always the chance for a delay, or much less likely, a deal-killing glitch. If you’re looking for a sign, each company has scheduled its second quarter earnings reports for Tuesday and a conference call with analysts for 10 a.m. the same day.

Will antitrust approval be needed? Possibly, but to date the Justice Department has only blocked mergers that would create new concentration of advertising and its pricing within a given market.

Bottom line, how likely is the new company to succeed? The deal does does not buy an exemption to the industry’s persistent problems of declining print advertising and circulation. And regional papers have been slow in building paid digital subscription numbers. However the resulting savings will make for a cushion of time to work out solutions.

A comparison to consider is the Sears/KMart merger in 2005. In essence two retail chains that were not competitive with Walmart formed a bigger chain that was still not especially competitive. But the married companies lasted until 2018; the merger made sense for providing “runway” to try new approaches.

The new Gannett, after the huge task of combining operations, might be able to add other regional groups like McClatchy or Tribune and achieve even more benefits of scale.

[the_ad id=“667878”]

Optimistically, I see industry progress — not yet life-saving — in diversifying revenues. And gains, too, in using digital traffic analytics to do fewer but stronger stories.

Those vacuum cleaners for advertising — Facebook and Google — are not going away. But the platform companies still show little interest or capacity for doing journalism on their own. Count that as a strategic advantage for the regional news companies, especially one this big.

Want more media news like this? Sign up for one of our newsletters.