With the failure of First Republic Bank, the U.S. banking sector has experienced three massive failures within just a few weeks.

It’s natural to ask questions. What happened? Why did it happen? How unusual is this? And could more failures be coming?

We examined the data and interviewed banking experts. Here’s what we found.

What happened?

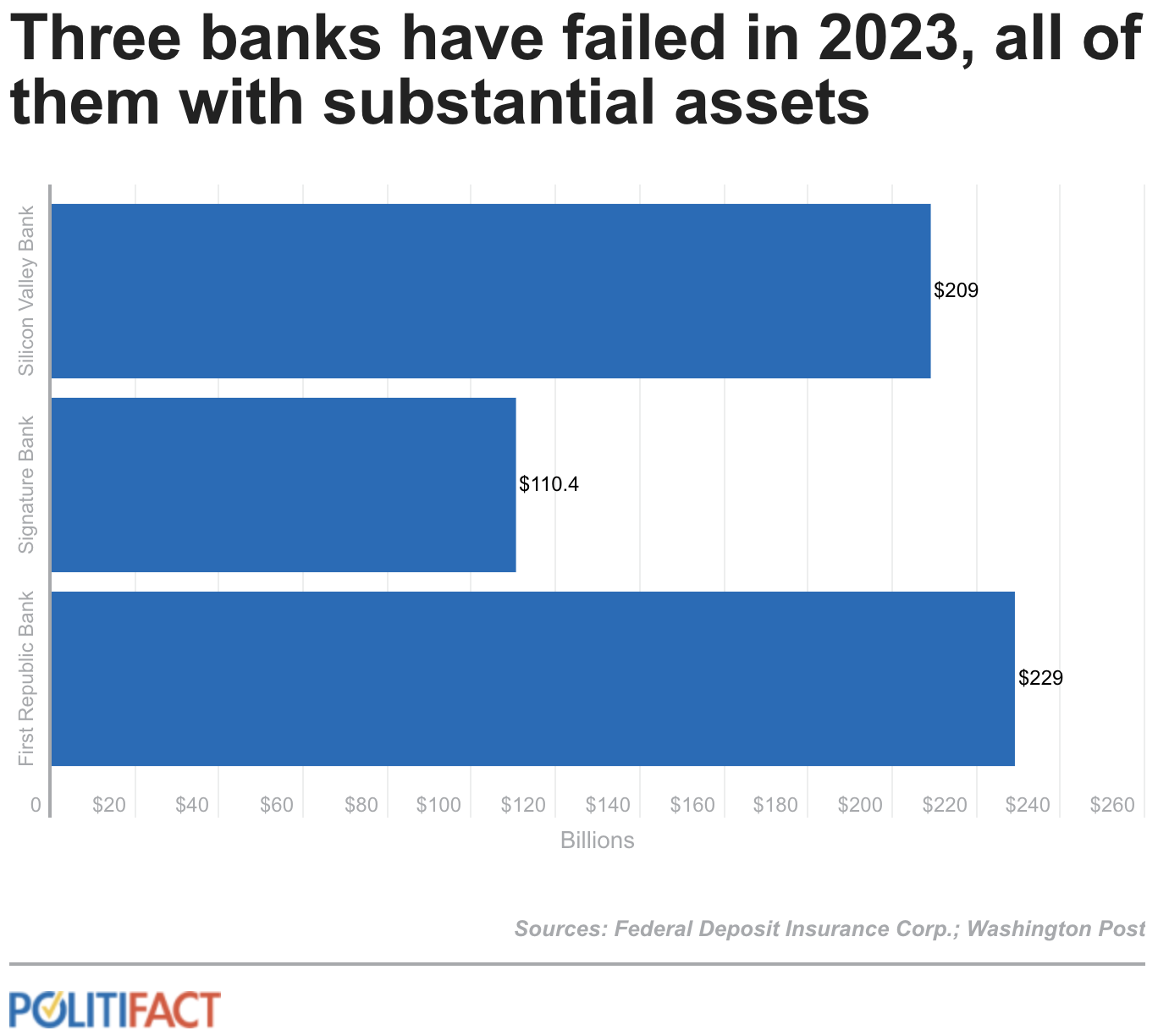

The first bank fell in March: Silicon Valley Bank. When it collapsed, it was the second-largest bank to fail in U.S. history and the largest since the 2008 financial crisis.

Silicon Valley Bank had a bank run — a situation in which a large number of clients, fearing the bank won’t be able to repay their deposits, all try to withdraw their money simultaneously. With demand for withdrawals outstripping the ready supply of cash, banks in this situation are doomed to fail.

Within days, Signature Bank followed suit. Then, in late April, federal regulators seized First Republic Bank and sold it to JPMorgan Chase.

Each ranked among the 30 biggest banks in the U.S. — but none belonged to the top tier of biggest banks, which includes giants such as JPMorgan Chase, Bank of America, Citibank and Wells Fargo.

(PolitiFact)

This list of three failed banks doesn’t include a fourth: Silvergate Bank, which shuttered earlier this year without intervention from the Federal Deposit Insurance Corp. (Officially, this doesn’t count as a failure because it was done without the FDIC’s involvement.)

Common threads exist between these failed banks. Each specialized in serving the technology sector, which has been adjusting to the slowdown of pandemic-era growth by cutting costs and staff. Also, Signature and Silvergate both had large books of business with the cryptocurrency sector, which has struggled since FTX, a crypto exchange, imploded.

How do these failures look in context?

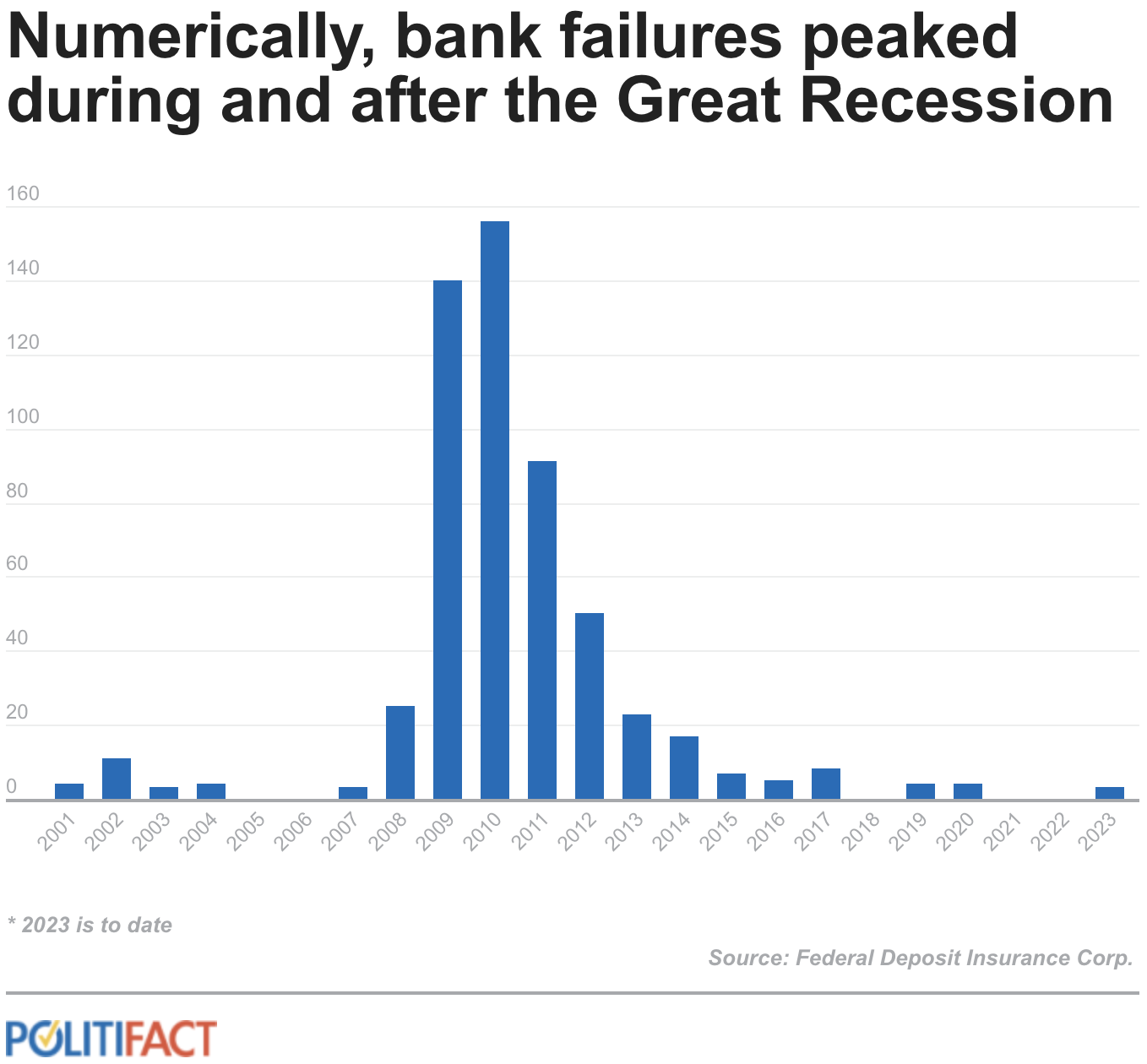

Numerically, the number of bank failures this year is small. Not counting Silvergate, these three failures are the only ones so far in 2023 — which is far smaller than the number of bank failures after the Great Recession hit in 2008. The number of failures peaked at 156 in 2010.

(PolitiFact)

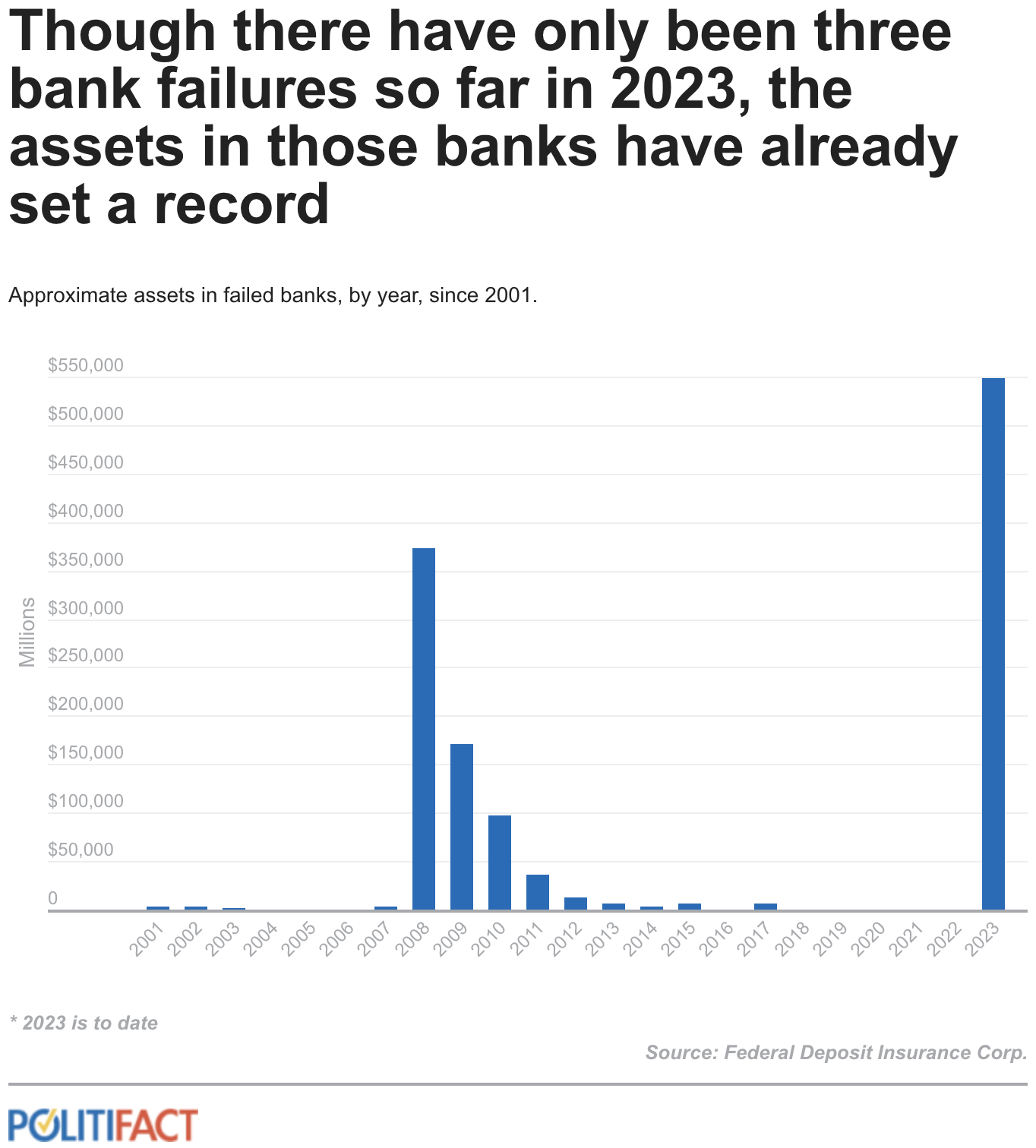

However, the scale of assets from just these three failed banks is unprecedentedly large.

Silicon Valley, Signature and First Republic collectively held an estimated $548 billion in assets. (The precise figure is tricky to pinpoint because during a bank run, an institution’s assets decline rapidly; the $548 billion figure refers to assets held during the period before the failure accelerated.)

This represents a larger asset total than in any previous year of bank failures. The previous record came in 2008, when banks that had combined assets of about $374 billion failed. (That was the year Washington Mutual failed; it remains the largest bank collapse in history, with $307 billion in assets.)

(PolitiFact)

Why did these failures happen?

The failures stem from a confluence of factors, experts say.

Poor risk management. To one degree or another, these banks were caught flat-footed when the Federal Reserve began raising interest rates in response to high inflation starting in mid-2022.

Bonds are considered safe, but they lose value when interest rates rise. That’s because investors would prefer to buy newer bonds with higher rates. In that situation, institutions that are stuck holding bonds need to sell them at a discount if they want to generate quick cash.

In a report following Silicon Valley Bank’s collapse, the FDIC laid much of the blame on the bank’s management, including inadequate safeguards and risk management policies during a period of rapid growth. The bank’s size more than tripled from 2019 to 2021.

“The Fed’s unprecedented increase in interest rates caught a few banks out over their skis,” said Aaron Klein, a senior fellow in economic studies at the Brookings Institution, a Washington, D.C., think tank. “Those banks were poorly managed, inadequately supervised, and deserved to fail.”

A legal rollback. Legislation signed by President Donald Trump in 2018 scaled back 2010’s landmark Dodd-Frank Act. The original measure was designed to increase financial services regulation to avoid a repeat of the crisis that tipped the nation into the Great Recession.

Dodd-Frank, passed mostly by congressional Democrats with a smattering of Republican support, overhauled and strengthened the nation’s financial regulatory system, tightening restrictions on speculative or risky investments and instituting “stress tests” on banks to ensure they could survive difficult financial scenarios.

The 2018 revisions of Dodd-Frank maintained stringent oversight for the largest banks but eased regulations for smaller and midsized banks. Whereas the original Dodd-Frank law mandated stricter capital and liquidity standards for institutions with $50 billion in assets, the rewrite raised the minimum for such requirements to those with at least $250 billion in assets.

The three banks that have failed this year were all under that threshold, meaning they escaped the most rigorous oversight.

“While it is impossible to say categorically that legislative rollback equals the bank’s collapse, it does seem that it made it more likely,” Hilary Allen, an American University law professor, told PolitiFact after Silicon Valley Bank’s collapse.

Sluggish oversight. The Federal Reserve, which plays a major role in overseeing the banking sector, has acknowledged that its oversight was insufficient.

In a report on Silicon Valley Bank’s collapse released April 28, the Fed wrote that its supervisors “did not fully appreciate the extent of the vulnerabilities as Silicon Valley Bank grew in size and complexity” and “did not take sufficient steps” to make sure the bank corrected its shortcomings.

“Regulatory standards for SVB were too low, the supervision of SVB did not work with sufficient force and urgency, and contagion from the firm’s failure posed systemic consequences not contemplated by the Federal Reserve’s tailoring framework,” the report said.

A reliance on uninsured deposits. Each of these banks had accumulated too many deposits above the FDIC insurance threshold of $250,000.

When depositors know that a large chunk of their deposits are uninsured, they will be quicker to move their assets elsewhere if they sense a bank’s instability. This increases the likelihood of a bank run, especially in an era of immediate information sharing on social media.

“We mostly solved the problem of runs on retail deposits with deposit insurance, but the growth in uninsured deposits” has become problematic, said Lawrence G. Baxter, an emeritus law professor at Duke University and former director of its Global Financial Markets Center. “Smart investors see trouble and they move their money.”

Making matters worse, the failed banks’ heavy reliance on specific sectors — high-tech companies, including cryptocurrency — was unwise from a risk-management perspective, experts said.

Are more bank failures to come?

No one knows the future, but there are reasons for both optimism and pessimism.

The banks that have failed so far share a certain tech-oriented profile that most banks don’t have.

But the economy is facing broader headwinds, including persistent inflation that has prompted the Fed to raise interest rates, and that could trouble banks for months. There’s also the risk of an economic shock if Congress and the president fail to raise the debt limit in time to prevent federal defaults.

“The entire system is based on confidence,” Baxter said. “If there is a crisis of confidence, that’s what would concern me.”

This fact check was originally published by PolitiFact, which is part of the Poynter Institute. See the sources for this fact check here.