My hope is that I can help you put some perspective on the way you report what happened Monday in the stock market. You will do your readers/viewers/listeners a disservice if you scare them with uninformed headlines.

Pay attention to "percentages" not just "points"

What happened on Wall Street Monday was not a "crash" a "crater" a "correction" a "tailspin" or any other hyperventilated event. "It's the worst fall since 2008" one story said. HuffPost screamed "Dow Plunges," while showing a graphic that truly looks like a "plunge."

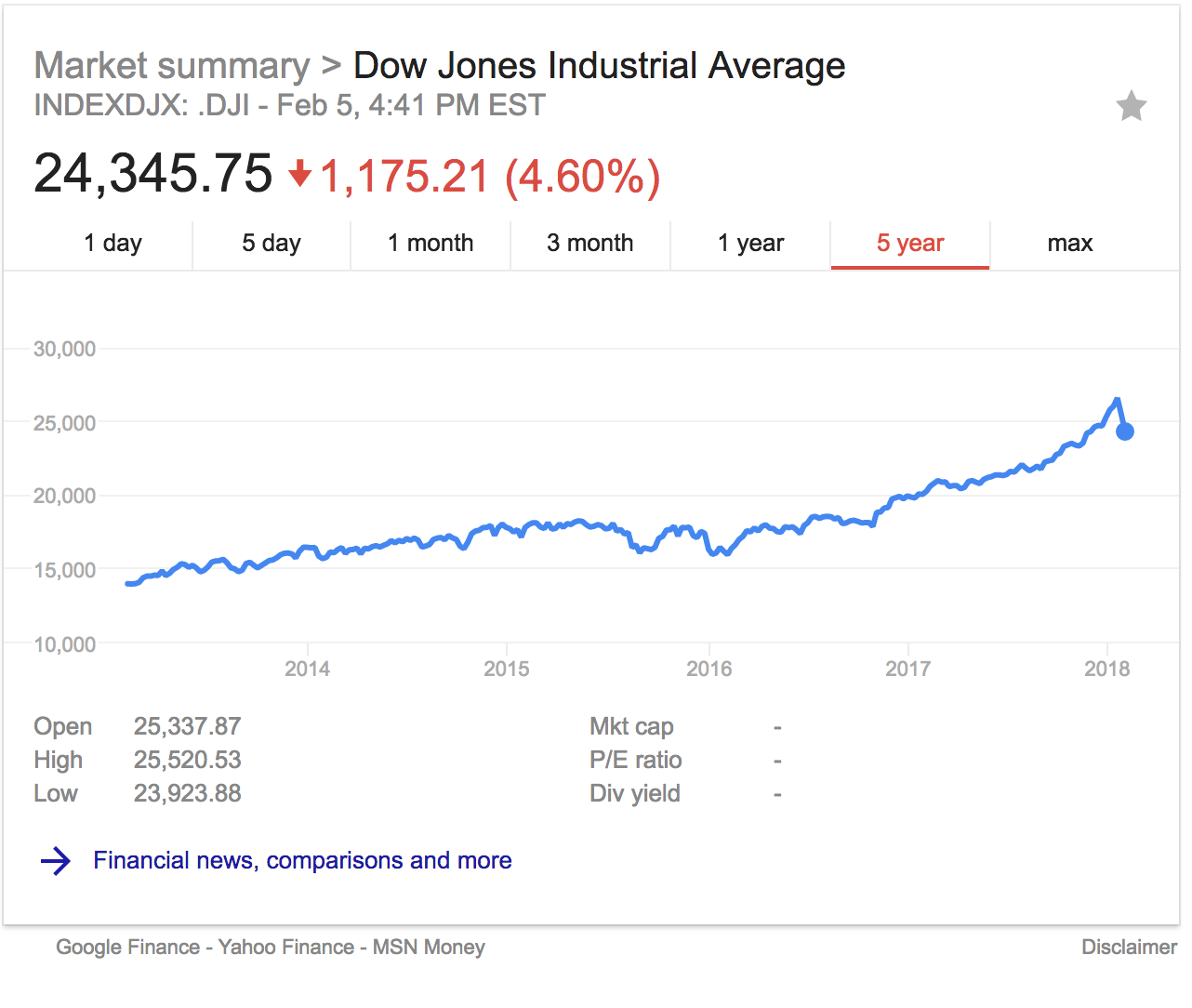

But let's add some context. The stock market always needs context. Monday, the market dropped 4.6 percent. It has done that before. In fact, it has done far worse in a single day.

The scary headlines focus on the "points" that the Dow dropped. True, 1,175 points is a record for a single day. The record before Monday was in 2008, when the market dropped 777 points, which accounted for a nearly 7 percent drop. As a percentage, the single worst day on the Dow was in 1987 when the Dow shed 22 percent of its value.

But the stock market has risen so fast in the past few years that the points are not as important as the percentage. As a percentage, the Dow dropped more in 2016 when Britain surprised everyone and voted in favor of leaving the European Union. Within a few days, the market gained back all it shed.

Other recoveries have taken a lot longer. MarketWatch points out, "It took 25 years for the market to recover from the 1929 stock market crash, and 16 years for stocks to bounce back from the combined effect of the Vietnam War, the 1973 oil shock and the resignation of President Richard Nixon."

The market has been rocketing upward

As a percentage, the market has risen more than four percentage points in a single day nine times since 2001.

Some writers will fixate on the fact that last Friday and Monday "wiped out" all of the gains the stock market has made since Jan. 1. That's true for most big stocks, but that ignores the fact that stock prices have rocketed upward in the past year, actually in the last few years. Look at this five-year snapshot for perspective.

The stock market can be a rough playground. Get a look at this chart from Chris Kacher, managing director of MoKa Investors, showing the ups and downs of the stock market going back to President McKinley.

Stock prices have been on a tear upward since President Trump took office.

It can be difficult to remember that it was barely a year ago that the Dow topped 20,000. And now it is still above 24,000 even after two rough trading days in a row. In 2017, the stock market set 70 — read that number again, 70 — record high closes.

The past week has been the first serious pullback in a year. Stocks sometimes have an "opposite and equal reaction" when they rise so fast and that is what former Fed Chairman Janet Yellen said might be happening right now.

What is the Dow?

In 1896, investors put a dozen stocks on a list to act as a reflection of the overall industrial companies that were publicly traded. The list, now 30 companies, changes from time to time and includes giant companies such as Boeing, Apple, Disney, Home Depot, WalMart and IBM. The Dow Jones Industrial Average is a price-weighted average of those 30 stocks that are traded on both the New York Stock Exchange and the NASDAQ exchange.

The wide range of companies in the Dow means after a wild couple of days, some stocks like Boeing and WalMart are still higher than they were at the start of the year. But most aren't. That's something of an illusion, though. For reasons that make no sense to me, investors often only look at how a stock has done since Jan. 1. That ignores what has happened for the past couple of years.

Does this mean companies are broke?

When stocks go up or down, the paper value of the company rises and falls. But corporate profits have been on a rocket train for the past year. Apple, Amazon and Aetna all reported record earnings. And that is just the first letter of the alphabet.

But stock prices do matter. Investors see stock prices as a reflection of a company's overall health. And since stock prices are generally linked to earnings, lenders use stock prices as one indication of a company's creditworthiness. If a company's stock goes too low, the company may become a takeover target. But broad market declines like we saw on Monday affect pretty much everyone.

What should investors do?

Remind the public that if they don't sell when prices go down, they have "lost" nothing. They still own the same number of shares they used to own.

Billionaire Warren Buffett, has offered this advice at previous downturns. Mostly he says, do nothing.

"Don't watch the market closely," Buffett told CNBC . "The money is made in investments by investing and by owning good companies for long periods of time. If they buy good companies, buy them over time, they're going to do fine 10, 20, 30 years from now."

For young investors, a market correction is good news because, if you buy stocks at regular intervals, you will buy stocks when they are lower. The bad news comes if you are at or near retirement and it takes a long time for a correction to turn upward again. That's why advisors keep harping the advice to "rebalance" your investments as you age, putting more into less volatile investments such as bonds as you get closer to retirement.

What about BitCoin?

As rough as the road has been recently for stocks, so-called cryptocurrencies have really taken it on the chin. Some cryptocurrencies lost more than 15 percent of their value on Monday. That's on top of staggering declines in recent weeks. Bitcoins are worth half of what they were in December. a 56 percent decline. Gold is sometimes mentioned as a safe haven in volatile markets. Gold prices moved up a fraction Monday, but not much.

What about media stocks?

Are you sure you really want to know? Here's what happened Monday:

Gannett down 5.11%

Disney down 3.68%

Viacom down 3.35%

Tegna down 3.64%

Sinclair down 1.93%

New York Times down 3.91%

News Corporation down 3.53%

And get this: McClatchy is UP 1.30%. (Just don't look at the five-year chart and ruin the buzz.)