Covering COVID-19 is a daily Poynter briefing of story ideas about the coronavirus and other timely topics for journalists, written by senior faculty Al Tompkins. Sign up here to have it delivered to your inbox every weekday morning.

Covering COVID-19 is a daily Poynter briefing of story ideas about the coronavirus and other timely topics for journalists, written by senior faculty Al Tompkins. Sign up here to have it delivered to your inbox every weekday morning.

On this Martin Luther King Jr. Day, I am going to focus our attention on issues that are directly related to racial minorities and the poor. The pandemic and the associated economic downturn have hit these populations harder and recovery for them will come slower.

Race, ethnicity and COVID-19

A website called EmbraceRace has a constantly updated collection of stories linking COVID-19 and sorts by topics related to race.

- Asian Americans

- Black Americans

- Latinx/Hispanic Americans

- Tribal Nations

- Immigrants and Refugees

- Other Racialized Groups

- General/Crossracial

Let me give you 16 story ideas that might interest you:

- Over 30% of nurses who died due to COVID-19 in US were Filipinos, GMA News Online, Nov. 27, 2020

- South Bay Vietnamese Americans wrestle with COVID-19, lack of information, San Jose Spotlight, Dec. 15, 2020

- Prosecutors: Hate crimes on the rise in King County — “Due to COVID, we have seen hate crimes cases come in against Asian Americans,” Northwest Asian Weekly, Dec. 3, 2020

- Data shows Black Americans are punished more harshly for COVID-19 violations, The Hill, Jan. 6

- Here’s What the New Round Of PPP Loans Means for Black-Owned Businesses, Forbes, Jan. 5

- A Covid-19 Relief Fund Was Only for Black Residents. Then Came the Lawsuits, The New York Times, Jan. 3

- 12,000 More White Children Return to N.Y.C. Schools Than Black Children, New York Times, Dec. 8, 2020

- Black Women, COVID-19 And Equal Pay, Essence, Dec. 7, 2020

- Latina Mothers, Often Essential Workers, Report COVID-19 Took Financial, Psychological Toll, UC Davis News, Jan. 8

- COVID In Chicago: Staying Home Is A Privilege Many Latino Communities Can’t Afford As Virus Devastates Families, CBS Chicago, Dec. 20, 2020

- Tribal Elders Are Dying From the Pandemic, Causing a Cultural Crisis for American Indians, The New York Times, Jan. 12

- Vaccine Distribution Must Protect Immigrant Workers Who Lack Lawful Work Status, Truthout, Jan. 9

- How Seattle’s Dining Shutdown Has Impacted Undocumented Restaurant Workers, Eater, Jan. 4

- There’s good and bad news for immigrants waiting to take steps toward naturalization, Miami Herald, Jan 2.

- How the pandemic highlights racial disparities in higher education, PBS NewsHour, Jan. 12

- Black, Latina and immigrant mothers are losing jobs as COVID-19 child care crisis grows, USA Today, Dec. 28, 2020

[the_ad id=”667826″]

What would a $15 per hour minimum wage mean to businesses and workers?

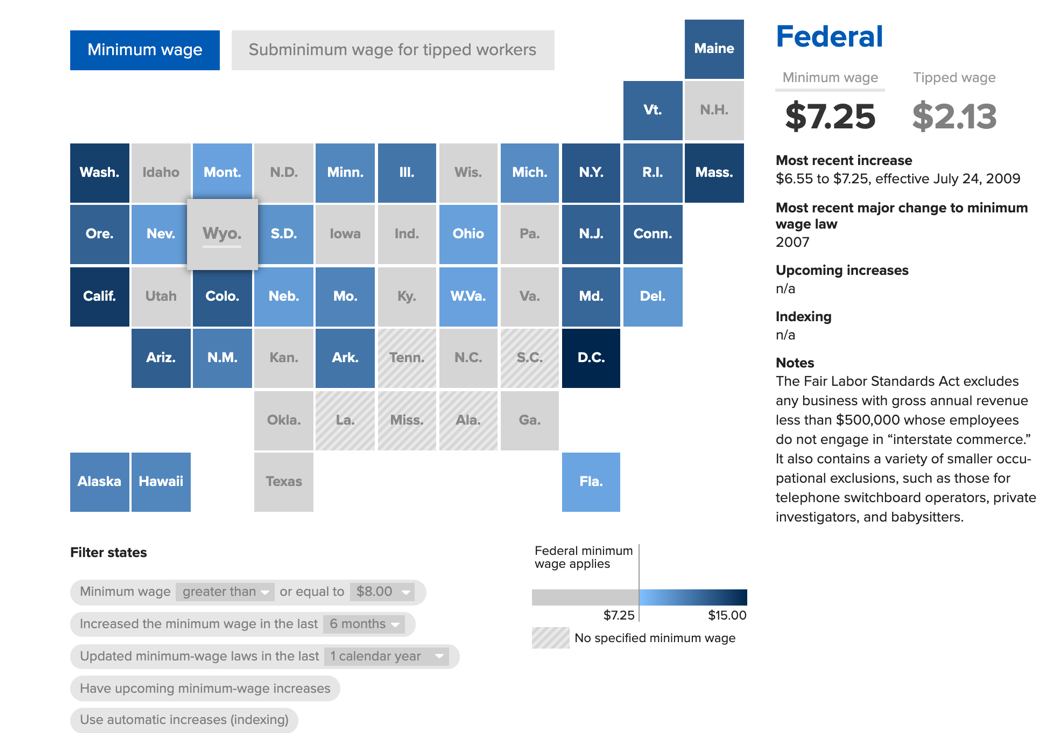

President-elect Joe Biden says it is vital to raise the national minimum wage and not depend on a patchwork of state laws to accomplish it. Florida just approved a referendum that raises the minimum wage to $15 an hour by 2026. The “fight for $15” movement is part of a wide effort to raise stagnant minimum wages. Not many states have gone up to $15 yet.

The campaign started to see results as over half of U.S. states and more cities went on to raise minimum wages, a few of them to $15. This, in turn, helped propel an extraordinary change in the U.S. economy: A few years later, wages started growing faster at the bottom than the top. The National Employment Law Project, which advocates for low-wage workers, estimates that new state and local wage laws gave some 22 million workers a collective raise of $68 billion.

The federal minimum has been stuck at $7.25 an hour since 2009. Businesses have long argued that higher wages risk hurting workers overall because their cost forces employers to weigh cutbacks on hours or even staff.

(Economic Policy Institute)

The Economic Policy Institute also is pushing for an end to sub-minimum wages for tipped workers. Workers who get tips — including, of course, waitstaff — depend on those tips, which once were thought of as a token of gratitude, as a central part of their income. It is one big reason why the pandemic has been so rough on restaurant workers who now have their customers take food out rather than eat in.

The EPI says:

The subminimum wage for tipped workers has remained at $2.13 since 1991. In 1996, it was decoupled from the regular minimum wage, such that the tipped wage remained at $2.13 even as the regular minimum wage was increased. At that time, the tipped minimum wage was equal to 50 percent of the regular minimum wage; today it is only equal to a record low 29.4 percent of the regular federal minimum wage of $7.25.

Customers’ tips pay the $5.12 difference between the federal tipped minimum wage and the federal regular minimum wage. Thus, customers provide a subsidy to employers of tipped workers worth more than twice the wage these employers are required to pay their tipped staff.

Tipped workers are predominantly women (66.6 percent) and disproportionately young; however, the majority are at least 25, and over one in four are at least 40 years of age.

Due to their low wages and higher poverty levels, about 46.0 percent of tipped workers and their families rely on public benefits, compared with 35.5 percent of non-tipped workers and their families.

President Donald Trump says minimum wage rates should be under state control because, he says, each state is unique.

Businesses claim that raising minimum wages will cost jobs, and that raising minimum wages in an economic decline is an even worse idea. But Business Insider reports the evidence is mixed.

A growing body of research so far indicates that some state and city-wage increases in recent years hasn’t set back the ability of employers to hire more workers. Evidence of job losses has not been consistent.

“One other thing that people may not realize is we’ve raised the minimum wage in weak economies in the past,” Jared Bernstein, an outside economic advisor to Biden and formerly a top aide during his vice presidency, told Business Insider. “The results have been the same.”

A nonpartisan analysis of the House Democratic proposal produced mixed findings. The Congressional Budget Office estimated it could increase paychecks for 27.3 million low-wage workers and lift 1.3 million workers out of poverty. It also suggested the economy could shed 1.3 million jobs.

Ben Zipperer, an economist at the progressive Economic Policy Institute, argues lifting wages would boost workers’ incomes during a period when wage growth tends to sharply slow down and even decline.

A 2019 analysis of over 130 minimum wage increases implemented since 1979 indicated the decline in jobs paying the hourly wage were offset by a rise in the number of jobs that paid more.

Who makes minimum wage? Good question. The Bureau of Labor Statistics paints this picture of who earns the minimum wage.

- 542,000 workers made the minimum wage

- 1.3 million made sub-minimum wage (including tipped workers)

- Half of minimum workers are 25 years old and younger.

- 3% of women and 2% of men made minimum wage.

- The more education you have, the less likely you are to work at minimum wage.

- 2/3rds of minimum wage earners work in food businesses, mostly restaurants

- States with the highest percentage of minimum wage workers were Kentucky, Mississippi, Tennessee, South Carolina, Louisiana, and Virginia (all about 4%). States with the fewest minimum wage workers were California, Washington, Montana and Minnesota (all less than 1%).

[the_ad id=”667872″]

Biden promises to focus stimulus on minority and women-owned businesses and the poor

President-elect Biden says, “Our focus will be on small businesses on Main Street that aren’t wealthy and well connected, that are facing real economic hardships through no fault of their own.”

“Our priority will be Black, Latino, Asian, and Native American owned small businesses, women-owned businesses, and finally having equal access to resources needed to reopen and rebuild,” he says.

But don’t look for that idea of targeting help to businesses to sail smoothly.

Racial discrimination, plain and simple. https://t.co/czSyOGhWCd

— Brit Hume (@brithume) January 11, 2021

Why not hard-hit, struggling business owners who need assistance, without regard to the color of their skin, gender or ethnic heritage? https://t.co/fcnzXCqaGH

— Ari Fleischer (@AriFleischer) January 12, 2021

Biden’s “Build back better” also includes a $10,000 forgiveness for student loans.

The new president will ask for a 15% increase in food stamp benefits, set to expire in June. In addition, he would invest $3 billion to help women, infants and children get food and give U.S. territories $1 billion in nutrition assistance.

Biden supports legislation called the FEED Act to partner with restaurants in feeding the needy. The FEED Act is aimed at not only providing food but directing business to struggling small and mid-sized restaurants that could supply the food. (FEED is short for the FEMA Empowering Essentials Deliveries Act.)

“As I speak, one in seven households in America — more than one in five Black and Latino households — report they don’t have enough food to eat,” Biden said. “This includes 30 million adults and as many as 12 million children. It’s wrong, it’s tragic, it’s unnecessary, it’s unacceptable.”

Biden says he wants to protect essential workers “who are disproportionately Black, Latino, and Asian American and Pacific Islander” and who “have risked their lives to stock shelves, harvest crops, and care for the sick during this crisis.” He added, “They have kept the country running even during the darkest days of the pandemic.”

The president-elect says he will call on Congress to direct the Occupational Safety and Health Administration to issue a COVID-19 Protection Standard. Those standards would offer safety protection to workers not normally covered by OSHA. “In the midst of a global pandemic, OSHA has been prevented from using its full range of tools to protect workers from COVID-19,” Biden said in December.

And Biden says employers should “meet their obligations to frontline essential workers and provide back hazard pay.” Biden says some big employers have made “bumper profitability” but have done “little or nothing to compensate their workers for the risks they took.”

What help will there be for renters?

You may not know this, but there was about $25 billion in “rental assistance” in the last stimulus bill. The money should be available through states starting Jan. 2.

The application process for rental assistance will vary depending where you live and you should contact your state’s housing department or local helplines and see how to apply.

To be eligible for rental assistance, you need at least one person in your household who qualifies for unemployment benefits or has proof of income loss due to the pandemic. Similarly, if you can prove that your household incurred a substantial uptick in expenses due to the pandemic, you can qualify.

You’ll also need to prove that you’re at risk of becoming homeless in the absence of aid by providing copies of past due rent statements or notices from your landlord. Plus, your 2020 income can’t exceed 80% of your area’s median income to qualify. That said, states have been instructed to prioritize very low-income applicants whose income is at 50% or less of a given area’s median income, as well as those who have been jobless for 90 days or more. And unfortunately, a lot of people meet the latter criteria in today’s economy.

The federal government’s website explains what benefits might be available:

Eligible households may receive up to 12 months of assistance, plus an additional 3 months if the grantee determines the extra months are needed to ensure housing stability and grantee funds are available. The payment of existing housing-related arrears that could result in eviction of an eligible household is prioritized. Assistance must be provided to reduce an eligible household’s rental arrears before the household may receive assistance for future rent payments. Once a household’s rental arrears are reduced, grantees may only commit to providing future assistance for up to three months at a time. Households may reapply for additional assistance at the end of the three-month period if needed and the overall time limit for assistance is not exceeded.

President-elect Biden says that this week, he will move to get help for 14 million Americans who face foreclosure. He says he wants to do more than just keep extending foreclosure moratoriums but instead envisions $30 billion in “rental assistance” and help for “mom and pop landlords” who have not gotten rental income for months.

Around 19% of renters were behind on their housing payments in December, according to the Center on Budget Policies and Priorities. Closer to 30% of Black renters were behind. Meanwhile, studies have also shown that evictions lead to significantly more coronavirus cases and deaths in an area.

Biden would also extend the federal eviction moratorium through September.

Biden wants $5 billion to help secure housing for people who are, or who are at risk of becoming, homeless. He is also going to ask for $5 billion to help cover utility costs for struggling renters.

You should also check with a wide range of local rental assistance programs around the country.

We’ll be back tomorrow with a new edition of Covering COVID-19. Sign up here to get it delivered right to your inbox.

[the_ad id=”667878″]