Covering COVID-19 is a daily Poynter briefing of story ideas about the coronavirus and other timely topics for journalists, written by senior faculty Al Tompkins. Sign up here to have it delivered to your inbox every weekday morning.

Covering COVID-19 is a daily Poynter briefing of story ideas about the coronavirus and other timely topics for journalists, written by senior faculty Al Tompkins. Sign up here to have it delivered to your inbox every weekday morning.

Axios reports this stunning headline: “Half of the pandemic’s unemployment money may have been stolen.”

The story continues: “Criminals may have stolen as much as half of the unemployment benefits the U.S. has been pumping out over the past year, some experts say.” Axios’ Felix Salmon reports that unemployment fraud may hit $500 billion and that states rushed to get the payments out the door knowing full well that fraud, even massive fraud, might be inevitable.

Some skeptics are asking for more documentation before they buy the $500 billion estimate but, without a doubt, investigators are tracking big-dollar losses. Salmon reports:

Blake Hall, CEO of ID.me, a service that tries to prevent this kind of fraud, tells Axios that America has lost more than $400 billion to fraudulent claims. As much as 50% of all unemployment monies might have been stolen, he says.

Haywood Talcove, the CEO of LexisNexis Risk Solutions, estimates that at least 70% of the money stolen by impostors ultimately left the country, much of it ending up in the hands of criminal syndicates in China, Nigeria, Russia and elsewhere.

“These groups are definitely backed by the state,” Talcove tells Axios.

There have been scattered reports of such fraud, but again, nothing that would add up to anything near $400 billion.

In Schenectady, New York, a man is accused of using multiple IDs to steal $141,000 in unemployment payments.

Texas alone figures it lost more than $890 million in unemployment payments to fraudsters … and that is just the money it knows about. There is likely much more. The state’s fraud tip line is getting more than three times the normal number of calls.

In California, a person who was on parole got another person who was in jail to collect the names and information of other people in jail. They filed $750,000 worth of fraudulent unemployment claims. Then, this week, we learned about an even bigger unemployment fraud case in California. This one also involved incarcerated people filing unemployment claims. They filed for more than $1 million and the state paid out $900,000 of it before catching on.

The California fraud is not just in state prisons but even in smaller county jails. In Butte County, more than a dozen people who were behind bars filed for hundreds of thousands of dollars’ worth of unemployment benefits and managed to get more than $400,000 in payments.

In Brooklyn, eight men scored $2 million in illegal unemployment payments and unwisely boasted about it on social media.

Washington state officials say they know about more than a half-billion dollars of unemployment fraud there. Authorities pinned the fraud on a Nigerian crime group called “Scattered Canary,” which also is accused of stealing money from unemployment programs in Florida, Hawaii, Maine, Michigan, Missouri, Montana, New York, North Carolina, Massachusetts, Ohio, Oklahoma, Pennsylvania, Rhode Island, Wisconsin and Wyoming.

The Secret Service detected $2 billion in fraudulent unemployment payments and was able to return the money to states. The federal agency says it is “extremely likely” that every state has been targeted by this fraud, or something like it.

Experts say the most common fraud involves fraudsters using the name of a person who is qualified for unemployment benefits. Sometimes the fraudsters steal the identity of somebody who does not qualify and typically it takes months for the state to catch on to the crime.

CNBC reports that some experts believe it might take two years to find some fraud:

The Secret Service also announced that it has seized more than $640 million in funds defrauded primarily from the Paycheck Protection Program and the Economic Injury Disaster Loan program. It opened some 690 unemployment insurance investigations and 720 investigations related to those two programs.

CNBC previously revealed that millions of dollars in Covid-19 funds had been laundered through online investment platforms.

NBC News reported in February that most of the 50 state workforce agencies did not yet know the full extent of their losses.

[the_ad id=”667826″]

The IRS is contacting 36 million families with money in hand

36 million families are getting letters from the IRS informing them that they may be eligible for a Child Tax Credit payment starting in a couple of weeks. The amount of money coming their way will be hundreds of dollars per month for the next six months.

The IRS announced:

The letters are going to families who may be eligible based on information they included in either their 2019 or 2020 federal income tax return or who used the Non-Filers tool on IRS.gov last year to register for an Economic Impact Payment.

A lot of households are about to come into this money. The Treasury Department says households of approximately 65 million children — or 88% of U.S. kids — will be eligible.

Yahoo money provides some detail:

The six advance monthly payments will be sent out on July 15, August 13, September 15, October 15, November 15, and December 15.

Families eligible for the credit will receive a second letter listing an estimate of their monthly payments. The amount will be determined by their 2020 tax return. If that return is not available, the IRS will use their 2019 return.

Eligible households will receive half of their total payments in advance over the next six months beginning in July and ending in December. The monthly payments will be $250 for older children and $300 for children under 6.

A single filer with children under 17 making up to $75,000 will receive the full payment for each child, while those earning up to $90,000 will get a reduced amount. Joint filers with children making up to $150,000 will get the full credit for their child, while those earning up to $170,000 will receive a smaller amount.

Single filers making over $200,000 and joint filers making over $400,000 will be eligible for the old credit, which is $2,000 per child under 17.

The only thing you must do to get whatever payment is due is to be sure you filed your 2020 tax return. The IRS portal, which is still under construction, will allow you to update your income, marital status and dependents.

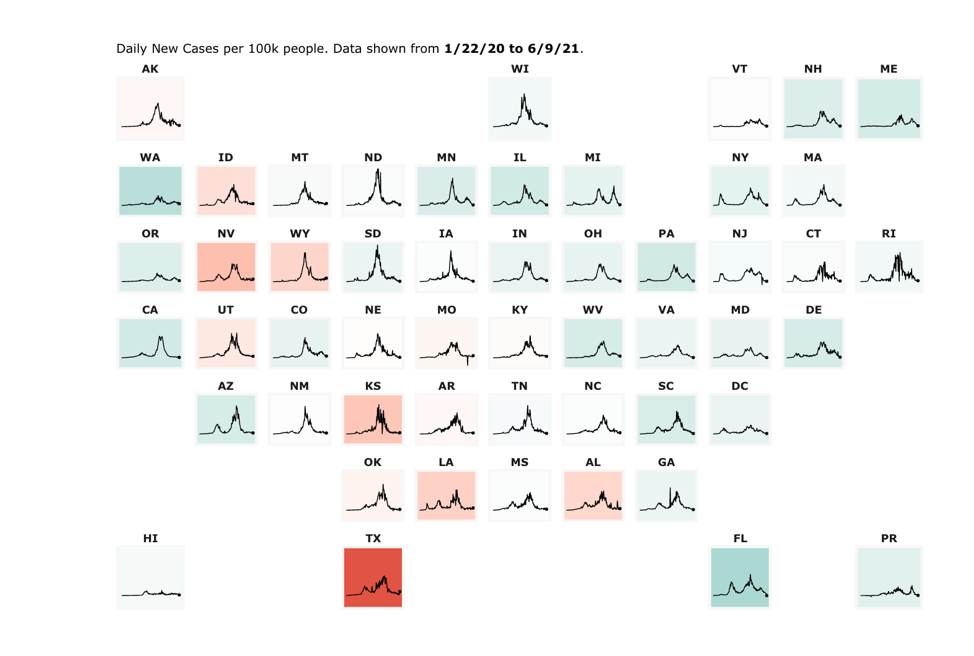

New cases rise for a third day

It has been a while since I have written a story about new COVID-19 cases increasing, but here it is. New daily cases and deaths from the coronavirus-borne illness rose for a third-straight day, with cases topping the 22,000 mark for the first time in over a week. In context, the seven-day average is still lower than two weeks ago.

Some southern states are seeing a new increase in cases. Those states are among the least vaccinated states. In all, 15 states have rising COVID-19 cases today. One week ago, only one state was experiencing rising rates.

It seems increasingly likely that America will not hit President Joe Biden’s July 4 goal of 70% of Americans having at least one vaccination dose. Each day, about 1.1 million doses are being administered. Again, by way of context, in April, that figure was more than 3 million a day.

To reach President Biden’s goal of having 70% of the U.S.’s adult population receiving at least one dose by July 4, the CDC data suggests that 15.73 million adults have to get at least one shot over the next 23 days, for an average of about 684,121 adults a day.

India’s COVID-19 spike appears to have peaked; now comes a second wave

A health worker administers the AstraZeneca vaccine for COVID-19 to a man inside his home at Minnar village, north of Srinagar, Indian controlled Kashmir, Thursday, June 10, 2021. (AP Photo/Mukhtar Khan)

India’s hospitals, which once were filled beyond capacity, now have some open beds and adequate oxygen supplies as the first wave of the COVID-19 pandemic appears to be easing. At one point, India was losing 4,500 lives to the virus each day. And still, less than 3% of the population is vaccinated. That is one reason that a next wave is nearly inevitable.

Meanwhile, The Wall Street Journal notes:

More people have died from Covid-19 already this year than in all of 2020, according to official counts, highlighting how the global pandemic is far from over even as vaccines beat back the virus in wealthy nations.

It took less than six months for the globe to record more than 1.88 million Covid-19 deaths this year, according to a Wall Street Journal analysis of data collected by Johns Hopkins University. The university’s count for 2021 edged just ahead of the 2020 death toll on Thursday.

[the_ad id=”667872″]

The biggest health insurer says if you go to the ER and do not have an emergency, you may not be covered

Imagine you have a pain or ache or injury and you go to the emergency room to get checked out, only to have the ER say, “Nope, you are fine” — a fairly common occurrence. The nation’s biggest health insurer is considering a rule change that would reject claims for such visits.

UnitedHealthcare, which covers 70 million people, says it will be taking a closer look at such ER claims. The new policy was to take hold July 1 but, after a public blowback, UnitedHealthcare says it will hold off until the end of the pandemic. ArsTechnica explains:

Doctors and hospitals are condemning plans by UnitedHealthcare—the country’s largest health insurance company—to retroactively deny emergency medical care coverage to members if UHC decides the reason for the emergency medical care wasn’t actually an emergency.

In the future, if one of UHC’s 70 million members submits a claim for an emergency department visit, UHC will carefully review what health problems led to the visit, the “intensity of diagnostic services performed” at the emergency department (ED), and some context for the visit, like the member’s underlying health conditions and outside circumstances. If UHC decides the medical situation didn’t constitute an emergency, it will provide “no coverage or limited coverage,” depending on the member’s specific insurance plan.

Doctors bashed UnitedHealthcare’s plan because they said patients will be left to self-diagnose their problems. And the doctors say some symptoms, like headaches and chest pains, could be a serious health issue or nothing much.

UnitedHealthcare, which just posted a 35% year-over-year jump in operating profits in the first quarter of 2021, said it was trying to cut the overuse of emergency rooms and urge patients to use lower cost options like urgent care centers.

Federal offices open wider to employees

Federal offices are opening their doors to more workers even while they plan to keep some telework plans in place. It will be especially welcome news for businesses near federal office buildings that depend on the traffic that hundreds or thousands of workers generate. Until now, there was a 25% occupancy cap on federal offices because of the pandemic.

The return to the office will be gradual, with federal agencies drafting their plans over the next few weeks and then giving workers a 30-day notice that they are expected to come back to the office.

This move is also important because the federal government is the largest employer in America, with more than 2 million workers. Other businesses are likely to take their cues from the government.

[the_ad id=”667878″]

We’ll be back Monday with a new edition of Covering COVID-19. Are you subscribed? Sign up here to get it delivered right to your inbox.