The Morning Meeting with Al Tompkins is a daily Poynter briefing of story ideas worth considering and other timely context for journalists, written by senior faculty Al Tompkins. Sign up here to have it delivered to your inbox every weekday morning.

Exxon scientists predicted in the 1970s and 1980s that climate change was coming and then opposed the science that would mitigate it, The Guardian reports in a concerning story. For years there have been reports of such research. And indeed, the research says that fossil fuels industries — including coal, utilities and the biggest auto companies — have had convincing evidence that fossil fuels were linked to climate change as early as the 1950s but downplayed it.

New analysis of the evidence just published in the journal Science says:

For decades, some members of the fossil fuel industry tried to convince the public that a causative link between fossil fuel use and climate warming could not be made because the models used to project warming were too uncertain. Supran et al (The Harvard researchers who produced this report) show that one of those fossil fuel companies, ExxonMobil, had their own internal models that projected warming trajectories consistent with those forecast by the independent academic and government models. What they understood about climate models thus contradicted what they led the public to believe.

Exxon has maintained that it has followed the best available science at any given time and has denied lying to the public in order to protect its business model. “I don’t believe companies should lie and I would tell you that we do not do that,” Darren Woods, Exxon’s chief executive, told a congressional hearing in 2021. Woods has said that Exxon now accepts that climate change is real and that it supports the goals of the Paris climate agreement.

The researchers point out, “Today, dozens of cities, counties, and states are suing oil and gas companies for their ‘longstanding internal scientific knowledge of the causes and consequences of climate change and public deception campaigns.’”

There are at least 20 pending lawsuits filed by cities and states across the U.S., alleging major players in the fossil fuel industry misled the public on climate change to devastating effect.

Karen Sokol, a professor of climate law at Loyola University New Orleans, called the suits “particularly distinctive worldwide, in that they’re the only ones, so far, that are seeking to hold the industry to account for its organized, systematic climate disinformation campaign.”Beginning with Rhode Island in 2018, attorneys general in states including Massachusetts, Connecticut and Minnesota have filed lawsuits citing oil and gas industry violations of local consumer-protection laws, following on the heels of similar lawsuits filed by some California cities as early as 2017.

The cities and states are filing suits partly because they are starting to recognize that climate change is costing them money as severe storms flood their streets and wash away bridges, shorelines and roads.

Why your tax refund may be smaller this year

The official tax filing season starts today. Your refund may be smaller this year.

The last time you filed your federal tax returns, Congress expanded several tax credits to help you through the pandemic. But when you file taxes for the 2022 tax year, you will find some of those credits have disappeared. The IRS says:

Some tax credits return to 2019 levels. This means that affected taxpayers will likely receive a significantly smaller refund compared with the previous tax year. Changes include amounts for the Child Tax Credit (CTC), Earned Income Tax Credit (EITC) and Child and Dependent Care Credit.

- Those who got $3,600 per dependent in 2021 for the CTC will, if eligible, get $2,000 for the 2022 tax year.

- For the EITC, eligible taxpayers with no children who received roughly $1,500 in 2021 will now get $500 in 2022.

- The Child and Dependent Care Credit returns to a maximum of $2,100 in 2022 instead of $8,000 in 2021.

As a result, the average tax refund in 2022 (for the 2021 tax year) was almost $3,200, a 14% jump from the prior year, according to IRS data. The typical tax refund this year will be closer to $2,700. The IRS is warning people who are anticipating a refund not to make major purchases by a certain date because it anticipates that some returns may undergo reviews that take time.

The changes could shrink refunds, or possibly result in a balance due in some cases.

Kathy Brown, president of the National Association of Enrolled Agents, a group for federally licensed tax preparers, said some taxpayers may be disappointed if they are expecting the same refund as last year.

Ms. Brown said she heard from a client who was eager to have her return processed so she could use her refund to take her child on a Disney vacation. Ms. Brown advised her to hold off on booking the trip, cautioning her that the refund “won’t be as large as it was last year.”

Some people who typically get small refunds or break even often file for an automatic filing extension, since they don’t feel a sense of urgency, Ms. Brown said. But this year, she said, filers shouldn’t assume they won’t have a tax bill. “They may not get a refund, and they may actually owe tax.” In that case, getting an extension may cost them interest and a late-payment penalty because an extension allows more time to file, but not to pay.

CBS News added a note about changes in the deductions for charitable giving:

The Coronavirus Aid, Relief and Economic Security Act, or CARES Act, had a provision that allowed taxpayers to deduct an extra $300 for single taxpayers or $600 for married couples on their 2020 and 2021 taxes.

This provision allowed people who rely on the standard deduction, which represents the majority of taxpayers, to take an extra deduction for charitable giving. But that above-the-line charitable deduction wasn’t renewed in 2022, which means that taxpayers who don’t itemize won’t get an extra deduction for their charitable gifts this year.

This year, people have three extra days to file their tax forms. April 18 is the 2023 tax deadline. The IRS explains, “By law, Washington, D.C., holidays impact tax deadlines for everyone in the same way as federal holidays. The due date is April 18, instead of April 15, because of the weekend and the District of Columbia’s Emancipation Day holiday, which falls on Monday, April 17.”

Read 4,600 comments about the FTC’s proposed ban on noncompete contracts

A week or so ago I told you about the Federal Trade Commission’s proposed ban on noncompete contracts that keep journalists, doctors, insurance agents, veterinarians, hair stylists, chefs and seemingly any other imaginable trade from applying their skills at the competitor’s shop. The FTC said it wanted to hear from the public about the proposed ban and already more than 4,600 comments have hit the FTC’s inbox. These are fairly typical of the comments in the file:

A “concerned citizen” wrote:

Charlotte Cody wrote:

But there are also comments from people like Penny Craig, who says she is an executive who supports noncompete contracts for some professions such as physicians.

It’s likely the FTC’s ban will get watered down, delayed, or even tossed out in court. Yet the proposal has revealed deep dissatisfaction with noncompetes among American workers, and some employers are taking notice.

The U.S. Chamber of Commerce says that the FTC simply doesn’t have the authority to do this. The FTC comment period ends in March. The Chamber said it would go to court if necessary to block its implementation.

Beyond money, why your job matters

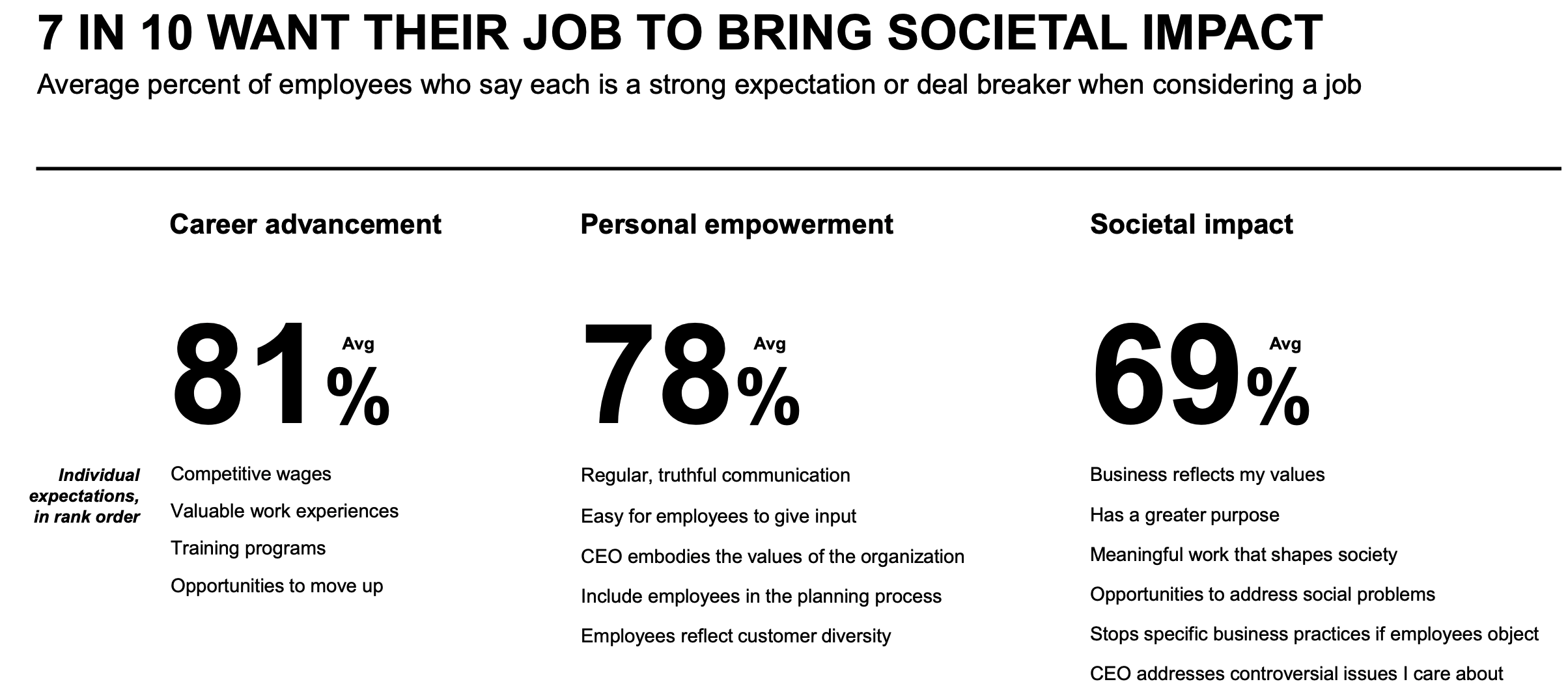

The new Edelman Trust Barometer provides a view of how important work and workplaces are beyond pay. The forword to the data says, “As today’s societal issues continue to mount, employees now see their workplace as a safe space for debate and turn to it as a primary source of community — before their neighbors and religious organizations.”

As one who sometimes teaches newsroom managers and leaders, the data reinforces to me how important it is for newsrooms to think about what the workplace means beyond a source of income.

The study says the workplace is a key source of “community,” which could underscore how important it could be for workplaces to work to build community even while — especially in the print and online worlds — a lot of journalists work remotely.

The survey says most American workplaces are doing a better job of keeping partisan politics out of the workplace. It also shows how important it is for employers to stand for public good, not just pump products out the loading dock.

For newsrooms, this tells us something about how vital it is to go beyond ratings or circulation figures, and to constantly focus on why the journalism you produce matters.

And employees want their companies to address real societal issues, like health care access, human rights and racial justice. This desire that companies stand up for important issues is true for people across party lines.